New Delhi: India is experiencing its first contraction in wages since the pandemic, signaling a slowdown in economic growth, as consumers reduce spending amid a corporate profit slump. According to a Bloomberg News report, inflation-adjusted wages for listed non-financial firms dropped by 0.5% year-on-year during the July-September period, as per data from Elara Securities Inc.

This decline in wages, combined with rising inflation, is putting significant financial pressure on India’s urban middle class, with analysts from Motilal Oswal Financial Services highlighting weak income growth as a primary factor behind stagnant consumer finances. The reduced income is expected to continue dragging down household consumption in the coming quarters.

The economic slowdown has been further exacerbated by falling consumer spending across various sectors, from basic goods to automobiles. Major companies, including Maruti Suzuki and Hindustan Unilever, have reported disappointing earnings, attributing the decline to weaker urban middle-class consumption. Data from Bloomberg indicates that nearly half of the companies in the NSE Nifty 50 Index missed earnings expectations in the second quarter.

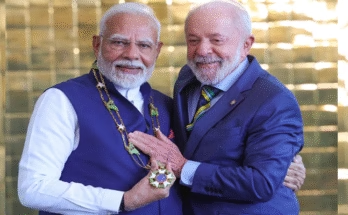

This trend poses a significant challenge for Prime Minister Narendra Modi’s growth ambitions and job creation targets. Internal differences have emerged within the government, with finance and trade ministers advocating for interest rate cuts to stimulate demand, while the Reserve Bank of India (RBI) remains focused on controlling inflation. Meanwhile, opposition parties have criticized the government for failing to address the economic struggles of the middle class.

Analysts have revised their GDP growth forecasts downward, with Elara Securities reducing its estimate to 6.8% for the fiscal year, while Goldman Sachs projects a growth rate of 6.4%. The RBI, however, maintains a more optimistic forecast of 7.2% growth.

Delays in government spending, particularly following national elections earlier this year, have also contributed to the slowdown. By mid-year, only 37% of the budgeted capital expenditure had been spent, compared to 49% in the previous year. However, rural recovery is underway, bolstered by a strong harvest, offering hope that the worst phase of the slowdown may soon be over.

Economists predict a potential rebound in the coming quarters as government spending accelerates and the RBI considers easing monetary policy, possibly beginning in February. ICICI Bank economist Sameer Narang notes that a boost in rural consumption and agricultural output could help offset weaker urban demand and industrial activity, providing support for growth in the months ahead.