by Ashis Sinha

The bilateral trade relationship between India and the United States has long been significant, albeit layered with complexities. In recent years, tariff policies — particularly on American goods imported into India — have emerged as central issues in global trade negotiations and diplomatic dialogue.

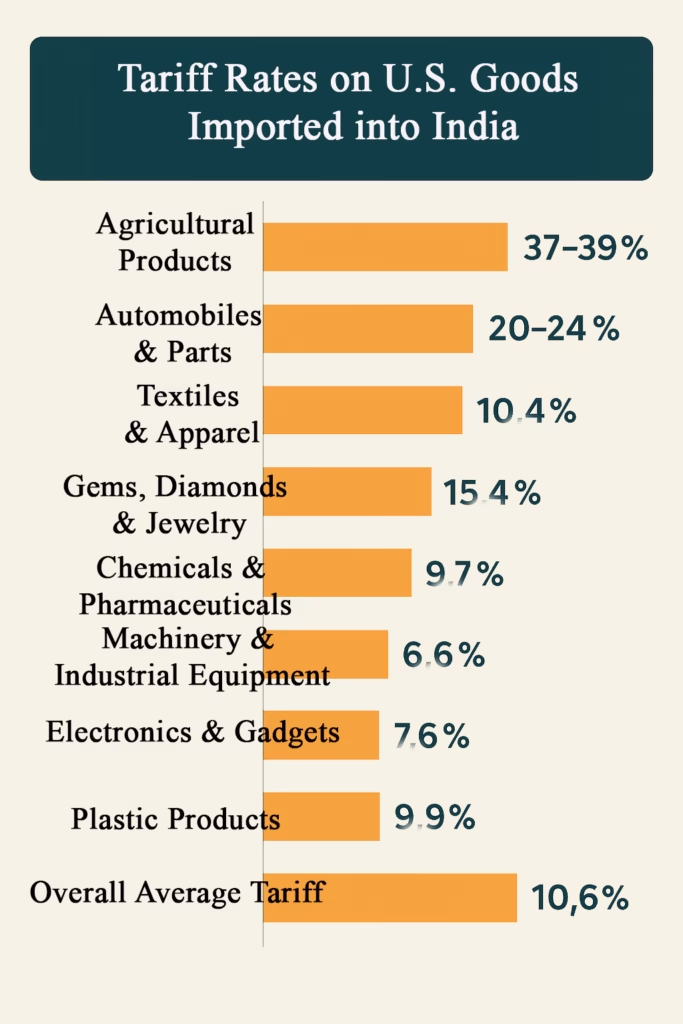

Current Tariff Structure on U.S. Imports

India imposes moderate to high tariffs on most U.S. goods, with rates varying across different categories. Here’s a look at the average tariff rates across key sectors:

| Product Category | Average Tariff Rate |

|---|---|

| Agricultural Products (almonds, wheat, shellfish) | 37–39% |

| Automobiles & Parts | 20–24% |

| Textiles & Apparel | 10.4% |

| Gems, Diamonds & Jewelry | 15.4% |

| Chemicals & Pharmaceuticals | 9.7% |

| Machinery & Industrial Equipment | 6.6% |

| Electronics & Gadgets | 7.6% |

| Plastic Products | 9.9% |

| Overall Average Tariff | 10.6% |

(Sources: Budget 2025–26 Trade Data, India-Trade Analysis, Reddit Trade Forums)

India’s Tariff Policy: Government Perspective

India’s tariff policy is designed to protect domestic industries — particularly MSMEs, agriculture, and labor-intensive sectors — from aggressive import competition.

-

Agriculture: High tariffs on imports like almonds, walnuts, pulses, wine, and shellfish from the U.S. aim to shield Indian farmers.

-

Automobile Sector: Import duties on U.S.-made luxury cars can go as high as 100%, staying within the limits allowed by the WTO.

In recent budgets, some tariff reductions have been announced, particularly on:

-

Solar equipment

-

Medical devices

-

High-tech semiconductor components

Bilateral Talks & Potential Tariff Reductions

The India-U.S. Trade Policy Forum has focused on several contentious and negotiation-worthy areas:

-

Possible tariff relief on iconic American products like bourbon whiskey and blue cheese

-

Differences over digital trade taxation

-

India’s response to the U.S. withdrawing GSP (Generalized System of Preferences) benefits

India has indicated it may consider lowering tariffs on U.S. imports worth up to $23 billion, provided there is mutual agreement on tariff reductions.

(Sources: India Today, Business Today, Economic Times)

India vs Global Tariff Averages

| Country/Region | Average Tariff Rate |

|---|---|

| India | 10.6% |

| USA | 2.4% |

| EU | 5.1% |

| China | 7.5% |

India’s tariff rates remain notably higher than global averages — especially in agriculture and automotive sectors — causing persistent concern among U.S. exporters.

Conclusion

India’s tariff framework on U.S. imports is complex, sector-specific, and guided by strategic policy objectives.

While the overall average duty stands at 10.6%, rates can soar up to 40% or more in some categories like agriculture and luxury vehicles.

Although ongoing bilateral discussions may lead to selective tariff relaxations, India’s core focus remains on protecting domestic industry and advancing self-reliance through the Atmanirbhar Bharat mission.