New Delhi: In its most sweeping overhaul since the rollout of the Goods and Services Tax (GST) in 2017, the GST Council on Tuesday approved a radical rate rationalisation aimed at easing the tax burden on households and boosting business confidence.

The new structure pares down multiple tax slabs to just two — 5% and 18%, alongside a steep 40% “sin and luxury” slab for items like tobacco, pan masala, sugary drinks and premium automobiles. The changes, set to kick in from September 22, slash levies on hundreds of consumer goods, agricultural inputs, household essentials, medical equipment and small business items.

Prime Minister Narendra Modi hailed the move as a “next-generation reform” that will touch every section of society.

“The reforms will benefit the common man, farmers, MSMEs, middle class, women and youth. They will improve lives and ensure ease of doing business, especially for small traders,” the PM posted on X.

During my Independence Day Speech, I had spoken about our intention to bring the Next-Generation reforms in GST.

The Union Government had prepared a detailed proposal for broad-based GST rate rationalisation and process reforms, aimed at ease of living for the common man and…

— Narendra Modi (@narendramodi) September 3, 2025

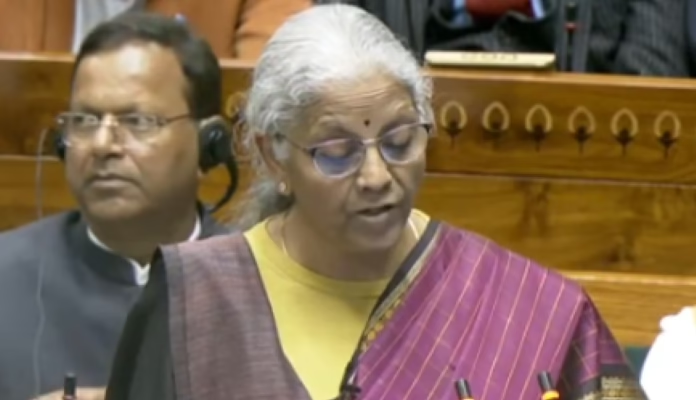

Finance Minister Nirmala Sitharaman, who chaired the 56th GST Council meeting, called the decision “historic” and said it would boost demand while simplifying compliance for businesses.

Analysts say the revamp — expected to cost the exchequer nearly ₹47,700 crore in annual revenue — will put more money in consumers’ pockets, stimulate rural demand, and lift sectors like FMCG, agriculture and handicrafts.

𝐏𝐌 𝐒𝐡𝐫𝐢 @𝐧𝐚𝐫𝐞𝐧𝐝𝐫𝐚𝐦𝐨𝐝𝐢 𝐚𝐧𝐧𝐨𝐮𝐧𝐜𝐞𝐝 𝐭𝐡𝐞 𝐍𝐞𝐱𝐭-𝐆𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐨𝐧 𝐆𝐒𝐓 𝐫𝐞𝐟𝐨𝐫𝐦𝐬 𝐢𝐧 𝐡𝐢𝐬 #𝐈𝐧𝐝𝐞𝐩𝐞𝐧𝐝𝐞𝐧𝐜𝐞𝐃𝐚𝐲𝟐𝟎𝟐𝟓 𝐚𝐝𝐝𝐫𝐞𝐬𝐬 𝐟𝐫𝐨𝐦 𝐭𝐡𝐞 𝐫𝐚𝐦𝐩𝐚𝐫𝐭𝐬 𝐨𝐟 𝐑𝐞𝐝 𝐅𝐨𝐫𝐭. 🇮🇳

Working on the same principle, the… pic.twitter.com/fcVysYKCDK

— BJP (@BJP4India) September 3, 2025

By making daily essentials cheaper and putting luxury and harmful goods under a heavier tax net, the Council has sought to strike a balance between relief for citizens and responsibility in consumption.

With this decision, the Modi government has delivered on its Independence Day promise of bringing “next-gen GST reforms,” signaling a sharper push towards economic growth through simplification and inclusivity.