by Dr. Vinod Chandrashekhar Dixit

by Dr. Vinod Chandrashekhar Dixit

India’s pension system has a long and principled history. Introduced by the British government in 1857, it broadly followed the pension framework then prevalent in Britain and was later formalised through the Indian Pension Act of 1871. The intent behind the pension system was clear: to ensure dignity, security, and social protection for employees after retirement.

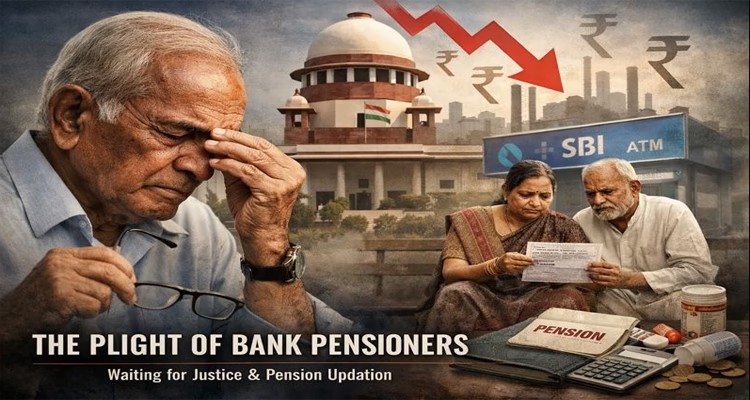

Yet, despite this legacy, millions of pensioners—particularly those from nationalised banks—continue to struggle for what the law itself recognises as a right.

The D.S. Nakara Judgment: A Turning Point

The modern pension movement in India owes much to late D.S. Nakara, a former official of the Ministry of Defence who retired in 1972. Like many others, he faced severe difficulties in securing a fair pension. His legal battle culminated in a landmark judgment delivered by the Supreme Court on December 17, 1982, which transformed pension jurisprudence in India.

In that historic ruling, the Court held that pension is not a discretionary benefit but a right flowing from past service. Pensioners across the country observe December 17 as Pensioners’ Day, paying tribute to D.S. Nakara for securing dignity and justice for retired employees.

Then Chief Justice of India Justice Y.V. Chandrachud memorably observed:

“Pension is neither a bounty nor a matter of grace depending upon the sweet will of the employer. It is a payment for the past services rendered… a social welfare measure rendering socio-economic justice to those who, in the heyday of their life, ceaselessly toiled for the employer.”

This judgment was meant to guarantee decency and financial security in old age. However, four decades later, its spirit remains unfulfilled for bank pensioners.

Bank Pensioners Left Behind

Retired officers and employees of nationalised banks continue to express deep concern over the absence of pension updation, despite enabling provisions being agreed upon nearly 30 years ago. While other public-sector pension schemes have seen regular revisions, bank pensioners have been consistently excluded.

The contrast is stark. The Reserve Bank of India revised its pension scheme for retirees in 2019 and again in 2023. Central government employees have seen pension revisions aligned with pay commission recommendations since 1996. Banking, however, remains the only organised sector where pension updation has been systematically denied.

The Bank Pension Scheme, implemented from November 1, 1993 (with retrospective effect from January 1, 1986), has remained frozen ever since. For thousands of retirees, this stagnation has translated into shrinking real incomes amid rising living and medical costs.

Legal Battle for Justice: The M.C. Singla Case

The long-pending M.C. Singla case before the Supreme Court (SLP (C) No. 5561/2016) has become a symbol of this injustice. The case seeks pension updation for bank retirees in line with wage revisions, invoking fundamental rights under Articles 14, 21, and 300A of the Constitution.

Despite repeated hearings and adjournments, the matter remains unresolved. As recently as November–December 2025, proceedings were deferred once again after the Indian Banks’ Association (IBA) sought more time to finalise its position. Pensioners, meanwhile, continue to press for parity with RBI and Central Government retirees, arguing that financial security in old age cannot be endlessly postponed.

Funds Exist, But Justice Does Not

The irony is painful. Pension funds—built from employees’ own contributions—continue to grow every year, even as the number of pensioners steadily declines. Yet those who remain alive are struggling to meet basic expenses due to the absence of genuine pension revision.

It is widely known that a favourable solution was once proposed by the Department of Financial Services (DFS) to the Prime Minister’s Office. However, the necessary approval never materialised. Without government consent, the IBA claims it cannot move forward, leaving pensioners trapped in a cycle of inaction and delay.

Time for the Government to Act

The Union Government must not forget the decades of service rendered by bank employees who played a pivotal role in building and stabilising India’s public-sector banking system. These retirees deserve more than token recognition—they deserve fairness, security, and dignity.

Even after forty years of the historic Nakara judgment, the plight of bank pensioners remains unresolved. The continued neglect of their legitimate demands is not merely an administrative lapse; it is a moral failure.

The time for delay is over. Pension updation is not charity—it is justice. The government must act decisively to ensure that those who contributed to the nation’s financial backbone are able to live their post-retirement years with dignity and peace.