Beijing/Washington: China has tightened its control over the global rare earth trade — a move that could trigger a major supply crisis across defence and high-tech industries, particularly in the United States.

Earlier this month, Beijing expanded its export control list, restricting five critical rare earth elements — holmium, erbium, thulium, europium, and ytterbium — along with dozens of associated magnet technologies. Under the new rules, any company using Chinese-origin materials or equipment, even if operating abroad, will now require Chinese approval.

According to the Centre for Strategic and International Studies (CSIS), the measure could disrupt international military production lines and delay deliveries of advanced weapon systems. The move also gives Beijing a powerful strategic lever amid rising global tensions.

China has just weaponised one of the world’s most powerful resources: #RareEarth materials.

From fighter jets to EVs and green tech, this move could reshape global supply chains. #Beijing’s new export restrictions directly target foreign military use and tighten control over… pic.twitter.com/U1XOLTP8nS

— CNBC-TV18 (@CNBCTV18News) October 19, 2025

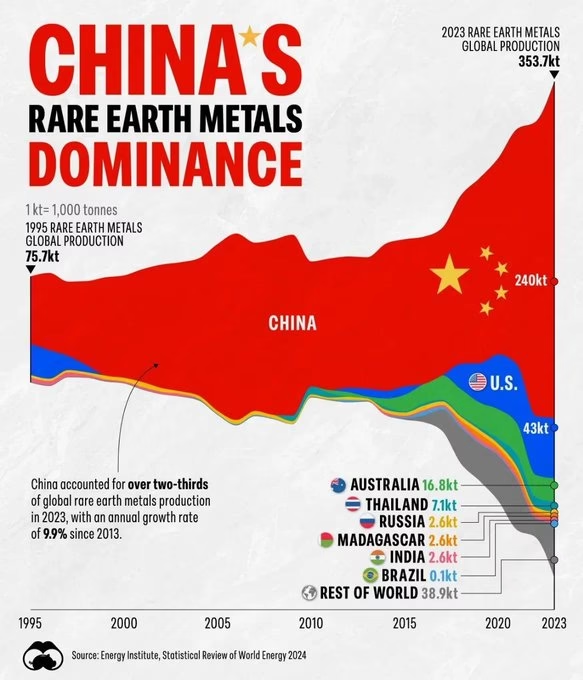

China’s Grip on the Global Supply Chain

China commands about 70% of the world’s rare earth mining, 90% of refining, and over 90% of high-performance magnet production — essential components in everything from fighter jets and missiles to electric vehicles, radars, and wind turbines. The International Energy Agency (IEA) has warned that such concentration creates “severe supply vulnerability” for the rest of the world.

Defence Sector on Edge

Analysts say the defence industry will be the hardest hit, as the new rules specifically restrict materials used for military hardware. The U.S. and its allies depend heavily on Chinese-made magnets and refined elements for the production of F-35 fighter jets, missile guidance systems, and precision radar components.

Industry experts see the move as a calculated step by Beijing to exert economic pressure on Western defence manufacturers. “This isn’t just about minerals — it’s about leverage,” said one senior defence analyst in London.

Global Fallout Beyond Defence

The restrictions are expected to ripple far beyond defence, affecting industries such as EV manufacturing, renewable energy, robotics, and consumer electronics — all of which rely on permanent magnets made from rare earths. Companies are now scrambling to find alternative sources in Australia, Canada, and the United States, though building new refining capacity could take years.

Strategic Warning

China’s export clampdown comes ahead of key diplomatic engagements between Beijing and Washington, underlining the geopolitical undertone of the decision. Experts warn that a “rare earth shock” — similar to past oil crises — could reshape global trade patterns and accelerate efforts by the West to secure critical mineral independence.

In a world increasingly powered by magnets, China’s latest move reminds everyone who holds the true key to modern warfare and technology.